Ask Aaron: Are Annuities Bad?

When it comes to researching your investment options, you’ll find a plethora of choices and lots of chatter about what the “best” investment options are. Among this chatter, you’ll no doubt hear the amazing benefits of annuities as investments. You may be thinking: “are annuities a good investment for me?”

On the other side of the spectrum, you might have friends or family members who have had poor experiences with investments in annuities and are quick to tell anyone who will listen. Their stories aren’t unique, as sadly there are many investors who have been hurt by overzealous salespeople, disadvantageous contract terms or a lack of understanding of what is one of the most complex investment products available.

So which is it? Are annuities bad? Or are they all they’re cracked up to be?

Let’s take a deeper look…

What is an Annuity?

First things first, let’s look at what an annuity is. An annuity is an agreement between an insurance company and an investor that includes a stream of regular payments. However, all annuities are not created equal, and it’s imperative to make investment decisions with your eyes wide open before you ever sign on the dotted line.

Who Offers Annuities?

Annuities are investment contracts offered by insurance companies. Insurance companies are able to offer certain guarantees that other financial institutions might not be able to offer such as death benefits, income benefits, or crediting benefits, also called riders.

On the outside, this seems like an appealing proposition. But if you come across an agent who seems to pressure clients toward one type of product or company, you might want to steer clear. Someone with a certain product to sell may not have much more in mind than selling as many of those products as possible in order to earn a commission, even though those products may not truly be best for their clients.

Perks of Annuities as an Investment

There are certainly perks to annuities as investments. After all, they’re still a popular investment vehicle for long-term investing.

The biggest perks to investing in annuities are the accompanying tax deferral and other possible guarantees. Many annuities are paid out in consistent, recurring amounts, which is very appealing to individuals looking to set up a consistent stream of income or obtain some type of certainty.

Downsides of Annuities as an Investment

On the flip side, annuities are often not the best investment choice. While they may come with a guaranteed return and other appealing incentives, there are almost always strings attached.

Unseen internal costs or penalties and long surrender schedules can impact your bottom line significantly. Depending upon the specifics of an annuity contract, the payout might not end up as all it’s cracked up to be. And if you’re already committed to an annuity, removing your funds could prove challenging and expensive.

Some Important Things to Remember about Annuities

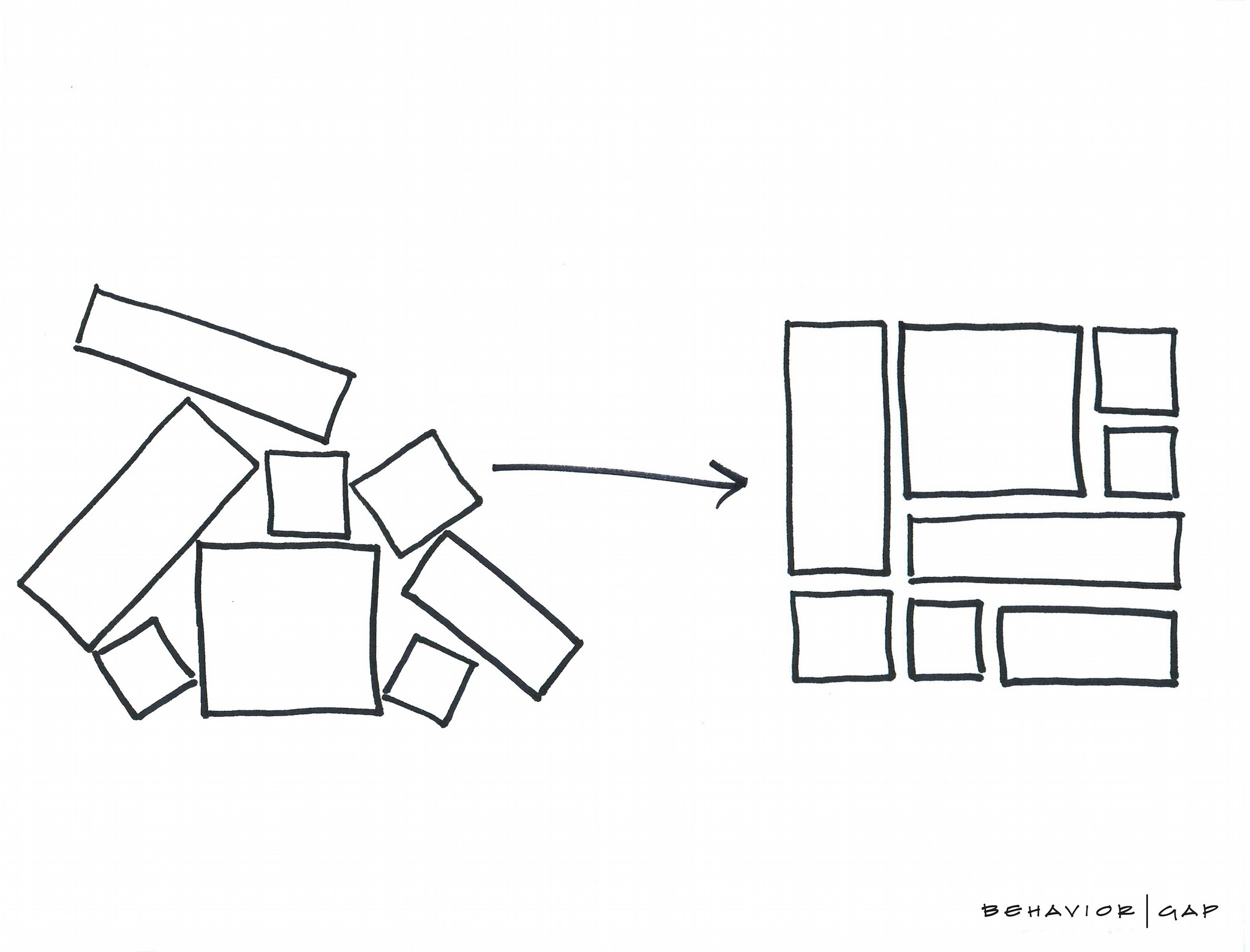

The most important thing to remember when it comes to annuities is that there is no single financial product that’s best for every investor. For some investors, certain annuities might be an ideal choice. For other investors, those same annuities might be a costly mistake.

And some annuities might be terrible investments, period – even for the most likely candidate. If it sounds too good to be true, it probably is.

Your individual financial situation is an essential driver behind which investments are the best for your portfolio. Instead of a sales pitch, you deserve a personalized recommendation based on an objective review of your specific situation.

At Puckett & Sturgill Financial Group, we take the time to get to know you personally before ever making recommendations for specific financial products. Are you curious about whether annuities are right for you? Reach out and schedule a consultation today!

Disclaimer: Fixed and Variable annuities are suitable for long-term investing, such as retirement investing. Gains from tax-deferred investments are taxable as ordinary income upon withdrawal. Guarantees are based on the claims paying ability of the issuing company. Withdrawals made prior to age 59 1⁄2 are subject to a 10% IRS penalty tax and surrender charges may apply. Variable annuities are subject to market risk and may lose value. Riders are additional guarantee options that are available to an annuity or life insurance contract holder. While some riders are part of an existing contract, many others may carry additional fees, charges and restrictions, and the policy holder should review their contract carefully before purchasing. Guarantees are based on the claims paying ability of the issuing insurance company.