Portfolio on Purpose

When you look at your investment portfolio, do you know why you own what you own?

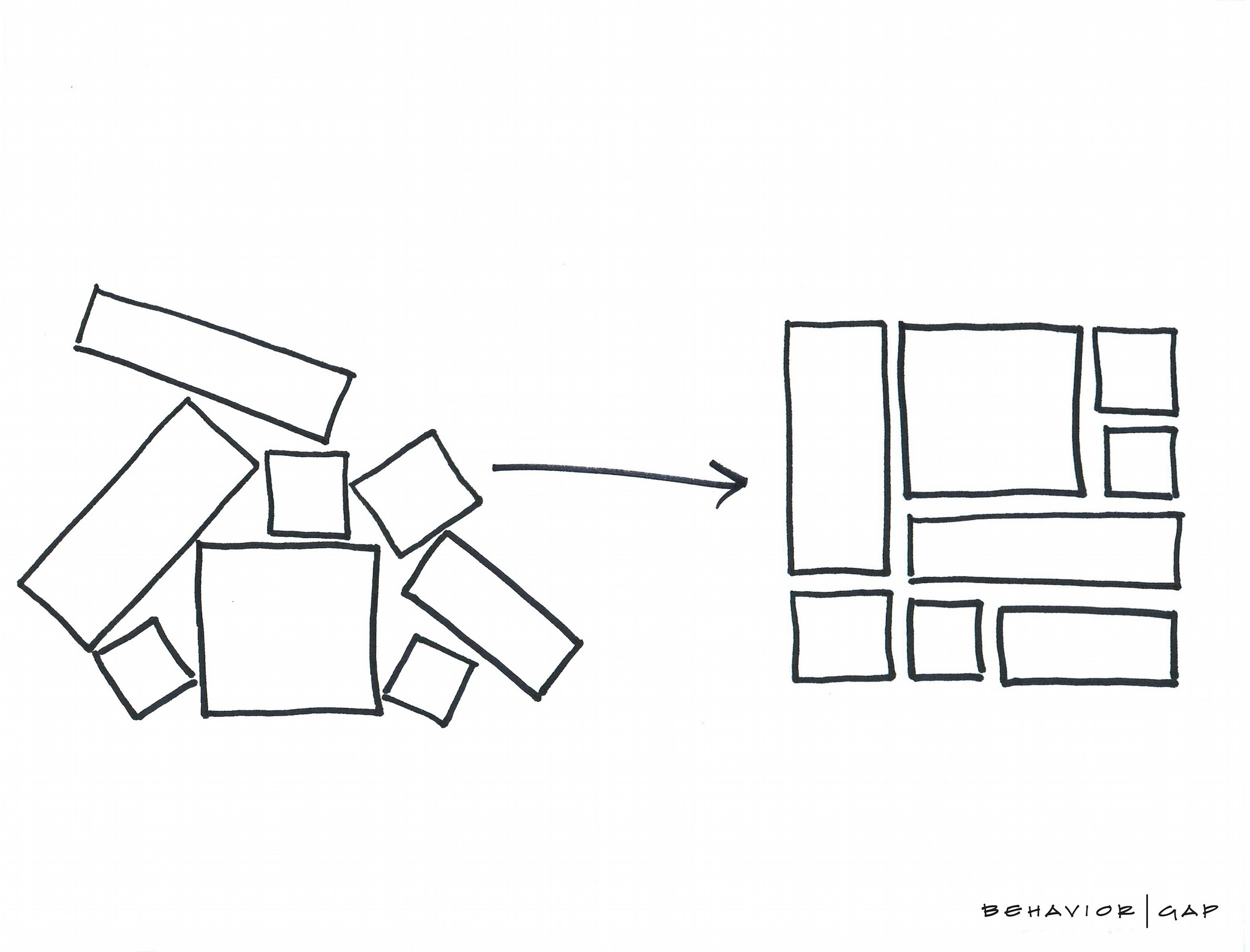

- Does it look like the picture on the left, an eclectic mix of things accumulated over the years?

OR - Does it resemble the picture on the right, with each piece intentional, organized, structured, well thought out?

If you’re like many people, your portfolio looks more like a collection – it has a little bit of everything in it. These bits and pieces might include inheritance, something you invested in after read about it (or saw it on TV, heard a tidbit from co worker), last years hot performer, and so forth.

In a purposefully designed portfolio, each piece of your portfolio should work together. The goal is not to beat “the market” (after all, what is the market anyway?), but for each piece to work in unison to achieve your goals.

Because your investments will eventually be used for something, you may believe the logical thing to do is start with viewing your investments in isolation. But you run the risk of hurting yourself in the long run.

Instead of viewing your investments myopically, it’s important to see the whole picture. You want to look at your investments as a means to an end, rather than the end in and of themselves.

Sounds easy enough.. How do we do it? First, start with end in mind.

DO: Prioritize Your Ideal Financial Future (Clarify Goals)

- Give yourself permission to take your best guess at your financial goals. For example, your favorite artist, movie, etc has likely changed throughout your life. Your idea today of your financial future may be different than what you ultimately end up prioritizing.

- If you start with a desired end point, it becomes easy to work backward to figure out what you need to do for your financial portfolio today.

- This can be very challenging. How do you know what is important to you? “They” say the checkbook and the calendar never lie. Start with your daily reality today and work from there.

DO: Develop a Plan

- Set realistic expectations for your portfolio performance.

- How much do you think you will need?

- How much can you reasonably save?

- When do you need your money? (i.e. what is your time-frame?)

- What rate of return do you need?

- While market performance is important, market performance should not be the ultimate goal – achieving your desired financial state should be.

DO: Find the Investments that Fit Your Plan

- Revisit your portfolio periodically (at least annually) and make smaller changes to it over time.

- If you know where you are going, it’s easier to know what it is going to take to get there. Think of going on a road trip; you know you’ll need to gas up at some point – but you probably don’t know which exit you’ll actually need to stop at!

Choose a Financial Advisor Who can Help

We are all human. Life happens. Things change.

There are always going to be things that seem like better options or bigger risks in the market. Sometimes it seems like one of these factors could jeopardize everything and you may be tempted to make changes.

Blind spots are, by their very definition, things we cannot see. A trusted advisor, like Jocob Sturgill, can help you clearly define your goals, set realistic expectations, sidestep common investment mistakes, and build intentional investment portfolios.

Contact Jacob Sturgill

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal.