5 Realities You Don’t Want to Face in 2017

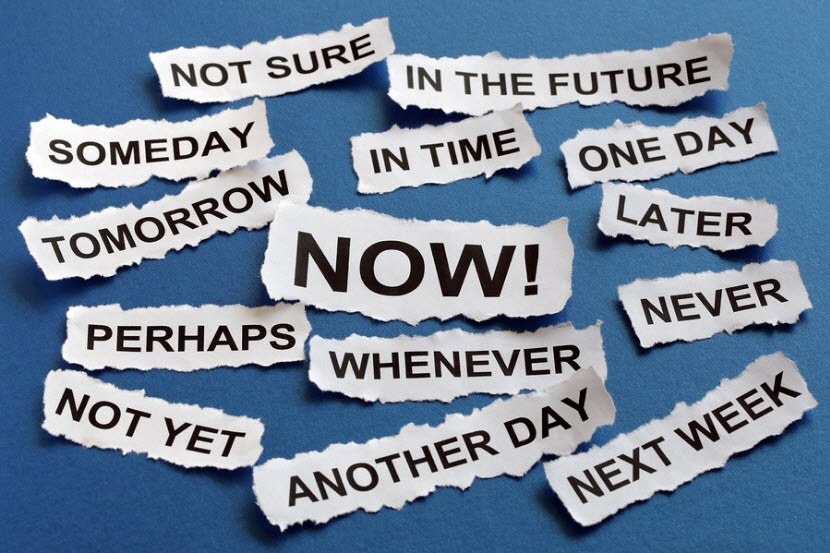

David Hemler, CFP® Another year is quickly coming to a close and with it the opportunity to tackle some financial tasks you may be pretending do not need your immediate attention or you may be ignoring all together. While the New Year signifies the opportune time to tackle the things we don’t want to face, I challenge you NOT to wait. Seize the day so you aren’t faced with any of these realities in 2017, which are often the byproduct of denial and procrastination.