The Bull Case for Stocks

Markets have been on a wild ride in September so far, with a strong first two days of the month followed by one of the sharpest 10% corrections ever for the NASDAQ. The case can be made that stocks may move higher over the rest of 2020 despite a number of risks, including a possible increase in COVID-19 cases, heightened US-China tensions, and election uncertainty.

Wild Ride

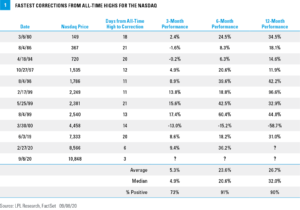

After virtually no volatility since March, market-watchers got a heavy dose of it with the recent three-day 10% correction in the NASDAQ—one of the fastest corrections ever, and the fastest ever from a record high. Historically, the NASDAQ has tended to rise after fast corrections from new highs [FIGURE 1]. Stocks were higher 6 and 12 months after those corrections more than 90% of the time going back 40 years, with the end of the 1990s bull market the glaring exception. Many of these examples took place during the technology boom in the late 1990s, but the history is still instructive.

Even with the 4% drop in the S&P 500 Index over the four trading sessions last week, and the nearly 7% drop from September 3 to September 8, the index is still up from the March 23 lows and higher year to date, as of September 11, 2020.

The Case for More Gains

The more difficult question is where stocks will go from here. We continue to believe stocks may be pricing in an overly optimistic recovery scenario in the near term and work is still needed for stocks to grow into their current valuations. However, we think the case for stocks to end the year higher from where we are now is a fairly strong one for several reasons:

- We’re getting COVID-19 under control. Though hotspots remain and school re-openings carry risks, the national numbers have improved steadily over the past couple of months. Daily new cases have been cut in half from the July peak of more than 70,000 to around 36,000 as of September 10. Hospitalizations have followed the same path, and the daily number of deaths has been cut by one- third since the start of August (source: COVID Tracking Project). We remain hopeful that a vaccine(s) will arrive by year-end, but in the meantime, we now have a better playbook of how to contain the virus’ spread and treat patients than we did in the spring.

- Economic reopening continues. Economic data has consistently beaten expectations as the economy has reopened. Gross domestic product (GDP) growth in the third quarter possibly may reach a record 30% annualized. The Atlanta Federal Reserve’s GDPNow forecast is tracking to 29.5%, while Goldman Sachs expects 35% growth. Retail sales have already passed their pre-pandemic peak, and housing is booming (source: US Census Bureau). Higher stock prices help support spending via wealth effects, and even though the chances have fallen in recent weeks, more stimulus help from Congress may still come before the election.

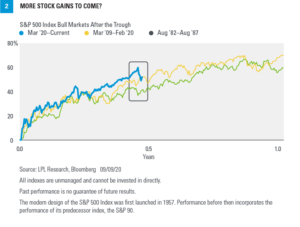

- Momentum breeds momentum. When the S&P 500 has been up five straight months, as it was in April through August, stocks historically have kept going higher. In fact, the last 26 times the index rose for five straight months, it was higher a year later 25 out of 26 times. We also know from history that bull markets tend to run for years, and the one that started March 23, 2020, is very young. That doesn’t mean we won’t have corrections along the way, as we did at similar points in the early 1980s and in 2009, but it tells us more gains may be coming [FIGURE 2].

- Earnings estimates are rising. Earnings estimates rose during second quarter earnings season and have continued to climb higher. Though not always predictive, estimate increases have tended to come in bunches, so we think the odds are good that estimates may continue to rise and third quarter earnings from corporate America may surprise to the upside.

- We expect the winners to continue to carry us. The so-called “work-from-home” stocks have powerful secular tailwinds that have only strengthened during the pandemic. We estimate more than half of the S&P 500 is either unaffected by the pandemic or benefiting from it, with about 40% of the index in technology, digital media, and e-commerce. Despite the recession, the consumer staples, healthcare, and technology sectors may all see earnings gains this year, according to the latest estimates from FactSet.

New S&P 500 Index Target

We have raised our year-end S&P 500 fair-value target to a range of 3,450–3,500. Fundamentals of the economy and profits are tracking more toward our bull case of 3450+ highlighted in our Midyear Outlook 2020 publication. Our new target range is based on a price-to-earnings ratio (PE) of 21 and our normalized earnings per share (EPS) estimate for the S&P 500 of $165, which we believe is achievable over the next 12 to 24 months. Earnings are being depressed temporarily by the pandemic, so this is our estimate of the earnings power of S&P 500 companies once the pandemic is behind us.

We believe the slightly higher valuation for stocks is justified based on monetary policy stimulus and depressed interest rates. The stronger-than-expected economic recovery, bolstered by stimulus packages, has sparked an earnings rebound that is helping stocks grow into their valuations. Steady progress toward reopening the economy and developing a vaccine may increase the chances our normalized earnings target may be reached within two years.

Conclusion

We expect to see some further upside for stocks over the final 2.5 months of 2020, but it may be a bumpy ride as the COVID-19 fight continues, investors struggle with election uncertainty, US-China tensions remain elevated, and we are in the middle of a seasonally weak period for stocks. Modest potential gains for stocks combined with limited return prospects for bonds support our decision to remain overweight equities and underweight fixed income relative to target allocations.

Read previous editions of Weekly Market Commentary on lpl.com at News & Media.

Ryan Detrick, CMT, Chief Market Strategist, LPL Financial

Jeffrey Buchbinder, CFA, Equity Strategist, LPL Financial

______________________________________________________________________________________________

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Please read the full Midyear Outlook 2020: The Trail to Recovery publication for additional description and disclosure.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

| Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value |

RES-84705-0920 | For Public Use | Tracking # 1-05054773 (Exp. 09/21)